Tax Compliance in Multilevel Tax Systems

Contact: external page Prof. Rose Camille Vincent

Utrecht University School of Economics

Focus Country: Uganda

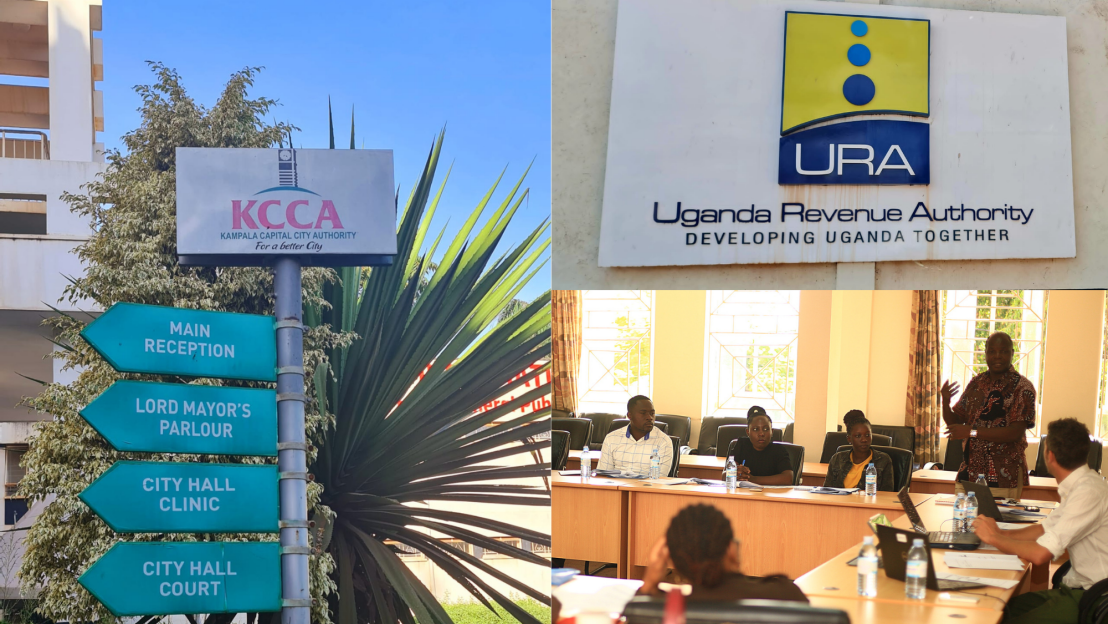

This research project investigates business tax compliance in a multi-level tax structure. It focuses on small and medium-sized firms in Kampala, the capital city of Uganda. Enterprises operating in Kampala are taxed at the local level by the Kampala Capital City Authority (KCCA) and at the national level by the Uganda Revenue Authority (URA). Kampala provides an ideal setting for understanding the compliance patterns of firms in the context of limited vertical coordination, given that the above agencies have been operating independently in their enforcement and collection of business levies in recent years.

The project leverages large-scale administrative tax data of more than 60,000 firms, complemented by survey and experimental data to investigate business compliance rates with the two streams of levies from KCCA and URA across the period of 2015-2022 and test interventions that could improve revenue mobilization across the board. In the project's first step, local and national tax registries are merged – a first in Kampala – and we analyze the compliance patterns of all businesses across eight years. Second, we conduct a large-scale survey with randomized modules to understand the business climate in Kampala and collect self-reported data on tax compliance. The survey, which includes randomized modules, also aims to measure self-reported tax compliance and validate the accuracy of different survey techniques in eliciting truthful answers on compliance. Third, we conduct a large-scale randomized control trial experiment in collaboration with the tax authorities and test optimal interventions that could improve compliance. The experiment also aims to analyze the spillover effects of the intervention on business tax compliance across tax layers.

This project is implemented by a consortium of researchers which includes Stephan Dietrich (Maastricht University / UNU-MERIT), Yannick Marhkof (Maastricht University / UNU-MERIT), and Firminus Mugumya (Makerere University). The project receives financial support from ETH4D, UNU-WIDER, and ICTD.

Project Partners: Uganda Revenue Authority & Kampala Capital City Authority